When you buy a cell phone, there are multiple ways you can pay for it:

- Buy outright

- Lease

- Pay monthly installments

Buying a cell phone outright is pretty straightforward, but leasing and monthly installments can get kind of confusing. This guide will walk you through the differences and help you decide which option is best for you.

Leasing Cell Phones

Leasing a cell phone is similar to leasing a car, or renting a home—you pay for it monthly, but you won’t own it unless you pay more for it at the end of lease. In that regard, leasing can leave a bad taste in some people’s mouth. However, over the course of an 18-month lease, you’ll still be paying less money than if you buy your phone outright.

Why Should I Lease My Phone?

Leasing isn’t for everyone, but there are a few people who could benefit from it:

- If You Like the Latest and Greatest Tech

- If you’re someone who is always spending money and upgrading to get the newest devices, leasing is definitely for you. You will save money, and be able to upgrade yearly (if you’re an iPhone or Galaxy person).

- If You Don’t Need to Own Your Phone

- Even though you CAN own your phone when you lease, it costs extra cash to make it happen. So, If you like upgrading regularly, and don’t need to own your device, leasing is a good option for you. If you fall into this category, just remember your phone needs to be in good condition when you return it and begin a new lease.

Get a new phone every year with a lower monthly cost through leasing

Leasing Can Cost More in the Long Run

According to the Daniel Research Group the average length of time a consumer keeps their device has drastically decreased over the years. In 2009 we were keeping our smartphones for over four years, and in 2018 we kept cell phones for about 2.6 years (or 31 months).

So how does this relate to leasing your phone? Well, if you were to lease to a phone for 2.6 years, the average amount of time consumers keep their phone before upgrading, you’ll end up paying more than a person who bought their phone outright or paid monthly installments. For instance, Sprint’s leasing program costs you $45.84/month for the 64GB iPhone XS Max. If you were to lease it for 31 months, you’d pay $1,421.04—which is $321.05 MORE than the cost of the phone. On top of that, you won’t get to keep the phone at the end of your lease period unless you pay extra for a buyout option.

| iPhoneXS Max | First Month | 6 Months | 12 Months | 18 months | 24 Months | 31 months (2.6 years) | TOTAL |

|---|---|---|---|---|---|---|---|

| Leasing | $46 | $275 | $550 | $825 | $1,100 | $1,421 | $1,421 |

| Buy Outright | $1,100 | $0 | $0 | $0 | $0 | $0 | $1,100 |

| Installments | $46 | $275 | $550 | $825 | $1,100 | $0 | $1,100 |

Pros

- Save money in the short term

- Can upgrade every 18 months

- You don’t have to pay one big lump sum

Cons

- Lose money in the long term

- Will never own the phone (unless you pay extra for the buyout option)

- Your phone has to be in good condition when you upgrade

- Not many carriers offer leasing options

Which Carriers Offer Leases?

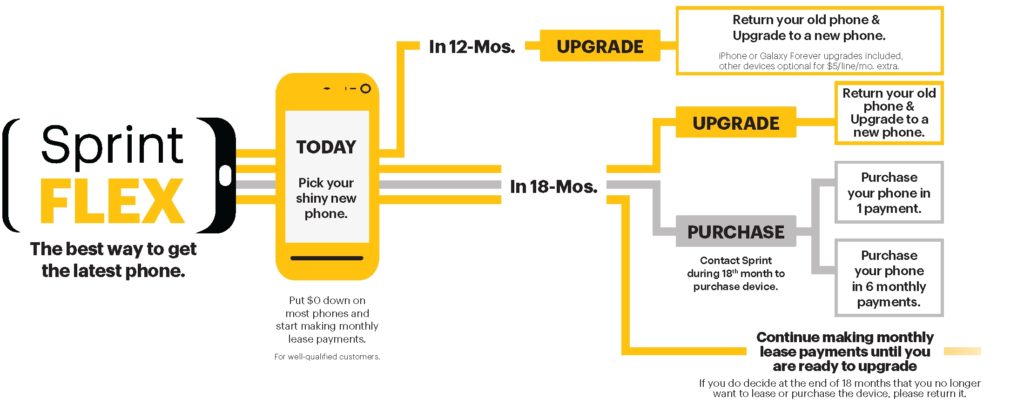

Right now Sprint is the only carrier that offers a lease option, and they aptly call it Sprint Flex. Sprint Flex is an 18-month lease program, and after 18 months you can:

- extend your current lease

- get a new lease with a new phone

- choose a buyout option and own the device

If you choose to upgrade and start a new lease, you have to return your phone to Sprint in GOOD condition. Sprint also offers an “iPhone Forever” or “Galaxy Forever” program that lets you upgrade to the newest device from either brand every 12-months.

Leasing a phone is best for tech junkies who have to have the best phone right when it comes out

What is a Monthly Installment?

Monthly installment plans allow you to pay off your cell phone month-by-month which takes the stress away from having to pay a huge lump sum at one time. With newer cell phones that cost upwards of $1,000, monthly installments are becoming more appealing to those who want to own a high-end smartphone of their own. Depending on your carrier’s monthly installment plan, you could be paying off your phone in three months or 30. The longer the installment, the lower your monthly payments are.

Which Carriers Offer Installments?

Of the major carriers, AT&T, T-Mobile and Verizon offer installment plans. Smaller carriers, also known as MVNOs, offer installment plans too but they work with third-party companies who will charge you interest over the course of your installments, so it’s more like a loan. If you don’t want to pay more than the price of the phone, you should buy your phone through a major carrier as they don’t charge interest.

Why Choose Monthly Installments?

Monthly installments, in this writer’s humble opinion, are awesome. Not only do installment plans from major carriers allow you to pay for your phone over time, there is no interest involved which allows you to save money instantly. Installment plans are perfect for someone who doesn’t want to drop a big amount of cash upfront, but still wants to own their phone.

Keep in mind that installment plans are void if you leave your carrier or cancel service before your phone is fully paid off and you will get a bill in the mail charging you for the remainder of payments.

Monthly installments are BEST for those wanting to own their phone and don’t want to pay for it all at one time

Pros

- You’ll own your phone at the end of the installment period (without paying extra)

- More carrier options (vs Sprint as the only lease option)

- You don’t have to worry about trading in your phone in good condition

- You can take your phone and switch carriers (once you own it)

- Trade your phone in to other carriers for trade-in credit (once you own it)

Cons

- You have a larger phone bill each month

- If you leave your carrier before your installments are paid off, you’ll get a bill for the rest of the payments

- Upgrading is more expensive

Leasing vs. Installments: Comparison Table

| Galaxy S10 | First Month | 6 Months | 12 Months | 18 months | 24 Months | 31 months (2.6 years) | TOTAL |

|---|---|---|---|---|---|---|---|

| Sprint Leasing | $38 | $225 | $450 | $675 | $900 | $1,163 | $1,163 |

| Buy Outright | $900 | $0 | $0 | $0 | $0 | $0 | $900 |

| AT&T Installments | $38 | $225 | $450 | $675 | $900 | $0 | $900 |

| Verizon Installment | $38 | $225 | $450 | $675 | $900 | $0 | $900 |

| T-Mobile Installment | $181 | $338 | $525 | $713 | $900 | $0 | $900 |

This table shows you that over the course of 31 months (the average length of time consumers keep their phones), leasing will cost you $263 MORE than buying outright and paying monthly installments. HOWEVER, if you were to upgrade and lease every 12 months with Sprints Galaxy Forever or iPhone Forever program, you’d only pay $450 before upgrading to a brand new device. And if you like upgrading frequently, it’s not a bad deal.

Let’s Talk Take

Monthly Installments:

We recommend monthly installments if you are money-conscious, and want to save as much as you can. Because consumers are keeping their phones longer than the length of installment plans, you’ll save hundreds over time. Plus there’s no interest, and you own your phone at the end without any extra fees.

Leasing:

We only recommend leasing if you’re a technology junkie and need to have the best flagship devices as they are released. The cost of leasing really adds up over time because you’re always paying a monthly fee, and never owning a device (unless you pay extra for it at the end of a lease).