Sprint Flex Lease Explained Other Installment Plans Let’s Talk Take

Years ago buying a phone took financial planning. You had to pay for it all at once, and that was quite a burden. However, these days nearly every carrier, big and small, offers some sort of installment or payment plan which allows you to pay for your new phone over time. One payment plan that can be confusing is the Sprint Flex Lease. This guide will walk you through the Sprint Flex Lease and help you decide if it’s the right type of payment plan for you.

What Are Installment Plans or Payment Plans?

Installment plans or payment plans allow you to pay for your phone over time in smaller monthly bills rather than one big lump sum at the point of sale. Some installment plans don’t charge any interest, and some do—before you settle on a specific carrier and plan, make sure you know what you’re getting into.

Sprint Flex Lease Explained

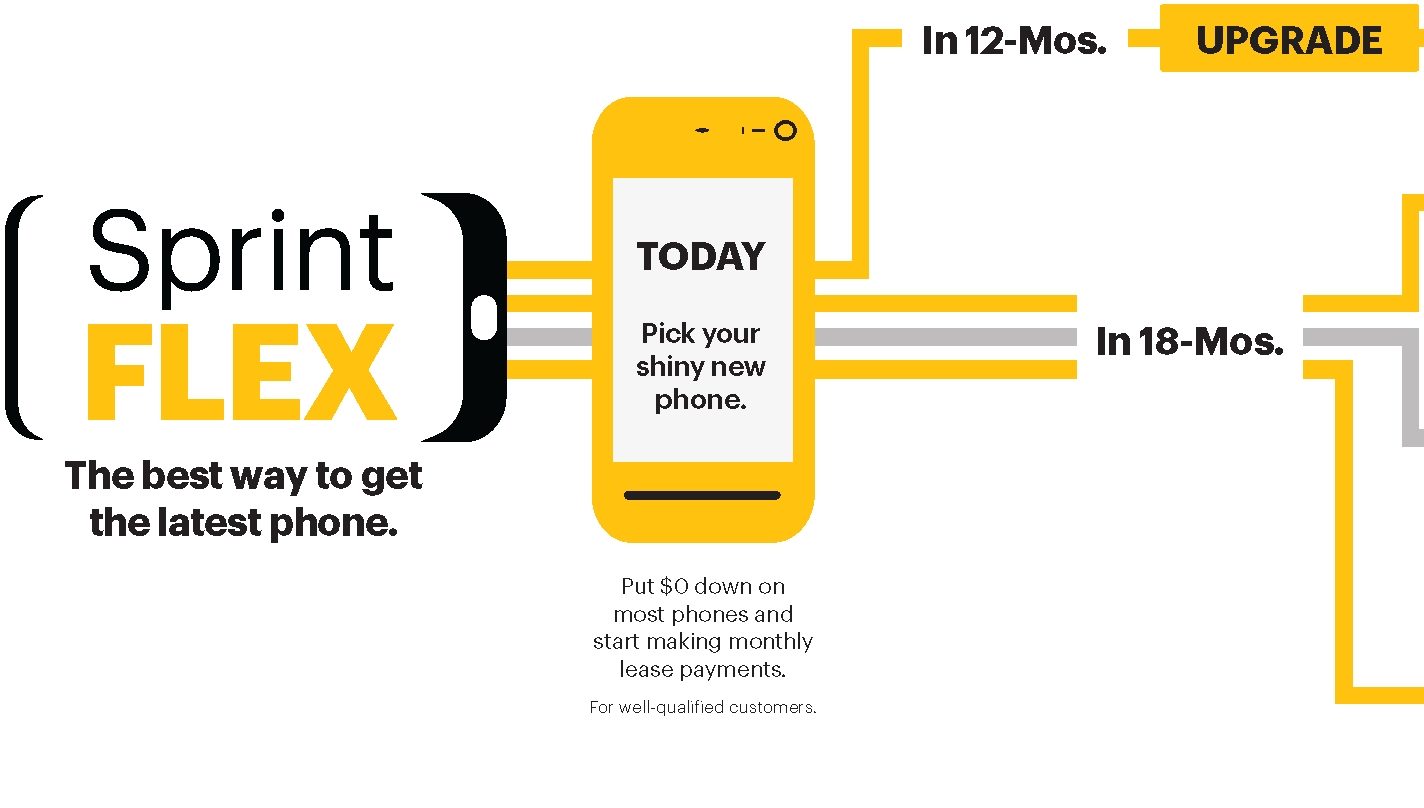

With the Sprint Flex Lease you’re leasing your device from Sprint for 18 months. After the lease is up you will NOT own your phone unless you pay a buyout fee after the lease is up. All together you have three options at or after your 18-month lease is up:

- You can buy the phone

- You can continue leasing the phone

- You can upgrade

At 18 Months

If you want to buy the phone you’ve been leasing you need to contact Sprint and tell them. Then you will pay the Purchase Option Price which is set at the time your lease began with the previous 18 payments going towards the final purchase price option. You will then pay off your phone in 9-monthly payments, or all at one time. If you don’t want to buy the phone, you can continue paying the monthly lease fee or upgrade.

Keep in mind that if you continue leasing instead of buying or upgrading, you will end up paying more than the phone is worth.

After 18 Months

After 18 monthly payments, your Sprint Flex Lease is technically over, though you can decide to lease it as long as you want. However, if you want to buy the phone, you will pay the Fair Market Value price (different than the Purchase Option Price above). Keep in mind that the 18 previous payments will not go toward the Fair Market Value and that may even be more expensive than the Purchase Price Option. To avoid spending more money, if you want to buy the phone, it’s essential to tell Sprint you want to buy the phone at the 18-month mark using the Purchase Price Option.

Sprint Flex Upgrade

At (and any time after) the 18-month mark, you can also choose to upgrade the phone to a newer model or brand. If you want to upgrade sooner than 18 months, you can choose to pay $5 more each month to upgrade after 12 months. If you choose this option you will have to return the phone back to Sprint, and you will NOT own the device at any point. The phone needs to be in good shape—Sprint could charge you fees if it isn’t. Depending on your lease, Sprint can charge you either $30 or $36 for each upgrade.

There is an exception to the $5/month yearly upgrade fee — if you are leasing an iPhone or Samsung Galaxy device, you’re automatically enrolled in Sprint’s iPhone/Galaxy forever program which gives you free yearly upgrades to the newest flagship devices.

Sprint Flex Lease Pros

- You will pay less in the short term

- You can upgrade to new phones regularly

- Sprint doesn’t charge interest with this payment plan

Sprint Flex Lease Cons

- You won’t own your phone (unless you pay more for it at the end of the lease)

- Will cost you more in the long run because you’re constantly renting

- Need to return the device in good condition

Sprint Flex Lease Fine Print

Notice for those living in specific states:

- DE, ND, NJ, NY, PA, PR (paying a rent charge): You can buy your phone during the lease period but not after.

- DE, IA, ID, ME, ND, NJ, NY, PA, WI, PR (not paying a rent charge): You can buy your phone during your lease or at the immediate end only. You cannot buy the device during the extended lease period.

Other Cell Phone Installment Plans

Sprint’s leasing plan is different than that of its major competitor’s installment plans—and depending on what you’re looking for, it may be off-putting. I’ll quickly go over the differences in the most popular payment plans so you can decide if going with Sprint, and a Sprint Flex Lease is your best option.

AT&T Next Up

AT&T Next Up lets you upgrade your phone after you’ve paid off at least 50% of the cost (on a monthly installment plan). You’ll pay an extra $5/month for this benefit.

Verizon Device Payment Plan

With the Verizon device payment plan you pay for your phone over 24 months. If you want to pay your phone off sooner you can do so at any time for free. If you want to upgrade to a new device, first you will have to fully pay off your phone.

T-Mobile Equipment Installment Plan

T-Mobile’s equipment installment plan breaks down into 24-monthly payments. Although the finance agreement is for 24 months, you can pay off the full price of the phone at any time without any early cancelation fees. Note, that T-Mobile will sometimes offer 36-month installments for select phones.

Affirm installments in the

Affirm app.

Affirm

Affirm is a third-party financing company that partners with some smaller carriers. Affirm payment plans differ in length depending on the carrier you’re with, but across the board, they can charge up to 30% interest. That means on a $1,000 phone, you could pay $300 more over the course of 24-month payment plan.

SmartPay

Similar to Affirm, SmartPay is another third-party financing who partners with MVNOs (smaller carriers) to help their customers buy phones through a payment plan. They also charge interest, but they don’t disclose how much on their website.

Let’s Talk Take

Sprint is the ONLY major carrier who offers a leasing plan, every other carrier offers installment plans. So, is the Sprint Flex Lease for you? Maybe. The Sprint Flex Lease is perfect for people who:

- Want a new phone every year

- Don’t need or want to own their own phone

- Want to save money in the short term

- Can take good care of their device (because you need to return it in good condition after the lease is up)

On the other hand, a Sprint Flex Lease ISN’T for you if:

- You don’t care about upgrading yearly

- You want to own your phone

- You want to eventually minimize your cell phone bill